Happy to help you

Customer care 99610 33333

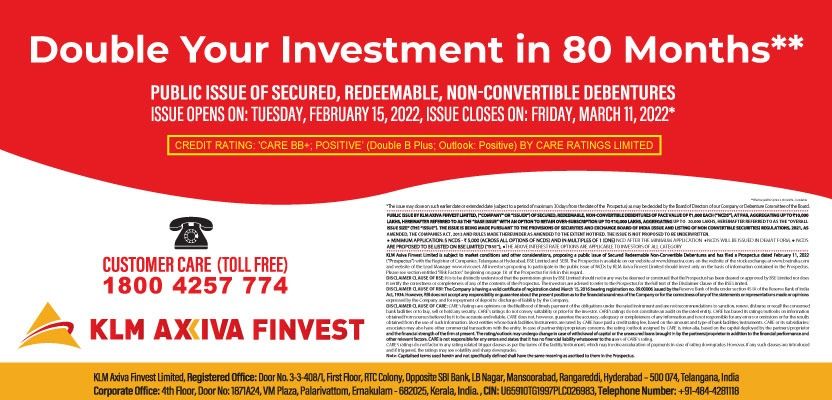

Toll free 1800 4257 774

Today's Gold Rate: ₹14,376.00/gram

Gold Loan Per Gram Rate* : ₹10,782.00

*terms & conditions apply

Gold Loan: Why It's Better Than Other Loans

Jan 5, 2024

Gold Loan: Why It's Better Than Other Loans

In the ever-evolving landscape of financial services, gold loans have emerged as a beacon of financial prudence and flexibility. As traditional loan options face increased scrutiny, gold loans are gaining traction for their unique advantages. This blog will delve into the world of gold loans, unravelling their intricacies and shedding light on why they stand head and shoulders above other borrowing alternatives.

What are Gold Loans?

Gold loans, as the name suggests, are secured loans where gold jewellery or ornaments are used as collateral. This financial tool has gained popularity due to its simplicity and accessibility. The borrower pledges their gold items in exchange for a loan amount, providing a secure avenue for quick and hassle-free borrowing.

Why Choose Gold Loans?

-

Lower Interest Rates and Processing Fees

Gold loans are often associated with lower interest rates and minimal processing fees compared to other types of loans, making them a cost-effective option for borrowers.

-

Minimal Documentation

Unlike conventional loans, which may require a plethora of documents, gold loans typically involve minimal paperwork, expediting the loan approval process.

-

No Foreclosure Charges

Gold loans often come with the advantage of no foreclosure charges, allowing borrowers the flexibility to repay the loan at their convenience without incurring additional fees.

-

Flexible Repayment Tenures and High Loan-to-Value (LTV) Ratio

Gold loans offer flexibility in repayment tenures, catering to diverse financial situations. Additionally, the high loan-to-value (LTV) ratio ensures borrowers can secure a significant loan amount against the value of their gold.

-

Different Loan Repayment Schemes

Gold loans provide various repayment schemes, allowing borrowers to choose the one that best aligns with their financial capabilities and goals.

-

Quick Processing

One of the most compelling features of gold loans is their swift processing. In urgent financial scenarios, gold loans offer a rapid solution, ensuring quick disbursal of funds.

Gold Loans at KLM Axiva

When it comes to securing a gold loan, KLM Axiva distinguishes itself as a reliable and customer-centric financial partner. Here's a closer look at how KLM Axiva offers gold loans, along with the unique features and benefits that set their services apart:

Visit https://klmaxiva.com/gold-loan

-

Streamlined Application Process

At KLM Axiva, the journey begins with a user-friendly and efficient application process. Prospective borrowers can initiate their gold loan application quickly, saving valuable time and effort. The straightforward interface ensures a hassle-free experience, with minimal steps required to get the process underway.

-

Competitive Interest Rates

KLM Axiva prides itself on offering gold loans at competitive interest rates. This commitment to affordability is a testament to their dedication to providing financial solutions that cater to the diverse needs of their customers. Borrowers can benefit from lower interest costs, making the overall borrowing experience more cost-effective.

-

Transparent Processes

Transparency is a cornerstone of KLM Axiva's gold loan services. From application to disbursal, every stage of the process is marked by clarity and openness. Borrowers can expect to be well-informed about terms, conditions, and associated costs, ensuring a trustworthy and straightforward lending experience.

-

Efficient Customer Support

Exceptional customer support is a hallmark of KLM Axiva's gold loan services. A dedicated and knowledgeable team is readily available to assist borrowers at every step of the process. Whether you have queries about the application, repayment, or any other aspect of the loan, KLM Axiva's customer support ensures a responsive and supportive experience.

-

Secure Storage Facilities

KLM Axiva understands the significance of the gold pledged as collateral. To ensure the safety and security of the pledged gold items, KLM Axiva provides state-of-the-art storage facilities. Borrowers can rest assured that their precious assets are in trustworthy hands throughout the loan tenure.

-

Quick Disbursal of Funds

Recognising the urgency that often accompanies financial needs, KLM Axiva excels at quick loan processing. Once the gold is appraised and the loan is approved, funds are disbursed promptly, offering borrowers timely access to the financial assistance they require.

Things to Consider Before Applying for a Gold Loan

Before embarking on the journey of obtaining a gold loan, it's crucial to consider various factors to ensure a well-informed and successful borrowing experience. Here are key aspects to ponder before applying for a gold loan:

- The purity of the gold being pledged

- Current market gold prices

- Loan-to-value (LTV) ratio

- Interest rates and additional charges

- Repayment capability and schedule

- Terms and conditions of the loan agreement

- Storage and security measures

It is essential to read the terms carefully and consult with a financial advisor to make informed decisions.

KLM Axiva's gold loan services stand out for their efficiency, transparency, and customer-centric approach. From a seamless application process to competitive interest rates and personalised solutions, KLM Axiva is a reliable partner for those seeking the advantages of gold loans. Explore the unique features and benefits offered by KLM Axiva today to embark on a secure and convenient borrowing journey. For more information or to embark on your gold loan journey, reach out to KLM Axiva today. Your financial freedom awaits.