Happy to help you

Customer care 99610 33333

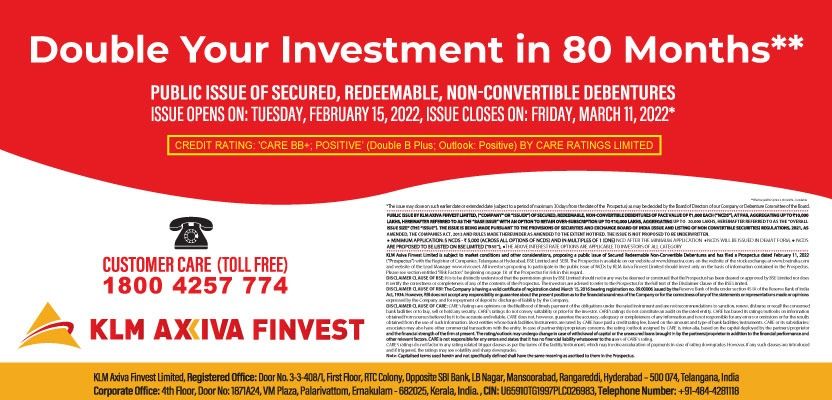

Toll free 1800 4257 774

Today's Gold Rate: ₹14,376.00/gram

Gold Loan Per Gram Rate* : ₹10,782.00

*terms & conditions apply

Common Myths About Gold Loans

Dec 12, 2023

Gold loans have been a financial instrument for centuries, providing individuals with quick access to funds by leveraging their gold assets. Despite their long-standing popularity, several myths surround gold loans, often leading to misconceptions and hesitations among potential borrowers. Understanding the realities of gold loans is crucial for individuals seeking financial solutions. Debunking these myths can empower borrowers to make informed decisions, ensuring they maximise the benefits of gold-backed financing without falling prey to unfounded fears.

This article aims to debunk these common myths, shedding light on the truth behind gold loans and their benefits.

Five common myths about gold loan

These are the five common myths about gold loan in kerala

Myth 1: Gold Loans are only for the Poor

A prevailing misconception is that gold loans are exclusively designed for individuals facing financial hardships. This myth undermines the versatility and widespread acceptance of gold loans. Gold loans are a versatile financial product that can be used for various purposes, such as starting a business, funding education, or even going on a vacation. People from different walks of life use gold loans as a strategic financial tool, not just those facing desperate situations. Gold loans offer a quick and hassle-free way to access funds, making them an attractive option for individuals who may not want to go through the lengthy approval process associated with traditional loans. The flexibility of gold loans allows borrowers to use the funds for both emergencies and planned financial endeavours.

Myth 2: Gold Loan Processing is Time-Consuming

Many potential borrowers believe that obtaining a gold loan involves a lengthy and cumbersome process, discouraging them from exploring this financial avenue. Contrary to the myth, gold loan processing is known for its speed and efficiency. With streamlined procedures and minimal documentation requirements, financial institutions like KLM Axiva ensure that borrowers can access funds quickly, making gold loans an ideal choice for urgent financial needs.

Myth 3: High-Interest Rates

There is a misconception that gold loans come with exorbitant interest rates, making them an expensive borrowing option. In reality, gold loan interest rates are often more competitive than those of unsecured loans like personal loans or credit cards. The interest rates for gold loans are influenced by factors such as the loan amount, the loan-to-value ratio, and the lender's policies. Moreover, the quick and straightforward approval process of gold loans makes them a cost-effective option, especially when compared to the lengthy and intricate procedures associated with other forms of credit. KLM Axiva provides gold loans with lower interest rates for their customers.

Myth 4: The Risk of Losing Gold

A significant concern among potential borrowers is the fear of losing their precious gold assets in the event of repayment challenges. In reality, the lender holds onto the gold only for the duration of the loan, and once the borrower repays the loan along with interest, the gold is returned to them. Lending institutions, like KLM Axiva, understand the sentimental and intrinsic value of the gold, and their primary interest is in providing financial assistance rather than acquiring physical assets. KLM Axiva also implemented high-security measures such as secure vaults and insurance coverage, assuring borrowers that their gold is in safe hands. Therefore, borrowers can rest assured that their gold is securely stored and will be returned upon loan repayment.

Also Read : How does gold become an instant solution for an emergency?

Myth 5: Limited Loan Amount

Some people believe that gold loans offer only small amounts of money, making them insufficient for meeting significant financial requirements. However, the loan amount sanctioned against gold depends on the purity and weight of the pledged gold. High-quality gold with a higher purity level can fetch a substantial loan amount. Gold loans are a viable option for those in need of significant funds, and lenders like KLM Axiva often appraise the gold's value fairly to provide borrowers with an appropriate loan amount.

In conclusion, accurate information is paramount to making informed financial decisions. Understanding the reality behind these myths empowers individuals to utilise gold loans strategically, whether for emergencies, planned expenses, or significant financial endeavours.

Remember, the world of finance can be complex, and it's perfectly normal to have questions. By seeking clarification and staying informed, you are taking proactive steps towards securing your financial future. Gold loans, when understood correctly, can be a valuable resource for achieving your goals and overcoming financial challenges.

In times of financial uncertainty or emergencies, your gold assets can be a valuable resource. Take charge of your financial well-being by exploring gold loan options with KLM Axiva. Our trusted and efficient services ensure a hassle-free process, providing you with quick access to the funds you need. Don't let emergencies catch you off guard; reach out to KLM Axiva today and discover how leveraging your gold can be a strategic solution.