Happy to help you

Customer care 99610 33333

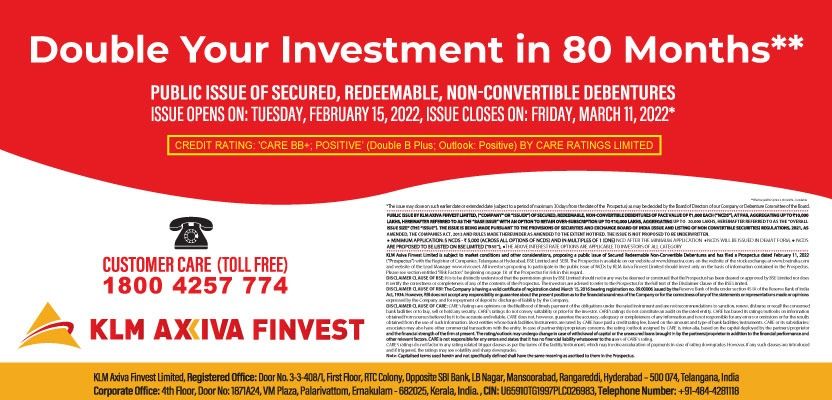

Toll free 1800 4257 774

Today's Gold Rate: ₹14,357.00/gram

Gold Loan Per Gram Rate* : ₹10,767.00

*terms & conditions apply

How gold loan can help you boost your credit score?

In today's financial world, having a good credit score is important as it affects your ability to obtain credit and the interest rates you pay on loans. A credit score is a numerical representation of your creditworthiness, and it is used by lenders to determine if you are a reliable borrower. If you have a low credit score, there are several steps you can take to improve it, and one of them is by taking a gold loan. Gold loans are a type of secured loan where you pledge your gold ornaments or coins as collateral to obtain funds. In this blog, we will explore how a gold loan can improve your credit score. 1. Building Credit History If you have no credit history, taking a gold loan can be an excellent way to start building it. A gold loan is an easy way to obtain credit since you are using an asset as collateral. When you take out a gold loan, the lender reports your payment history to credit bureaus, which helps build your credit score. Consistent and timely repayments on your gold loan can help establish your creditworthiness and lead to a higher credit score. 2. Diversifying the credit mix Having a diversified credit mix can also positively impact your credit score. A gold loan can help diversify your credit mix by adding an installment loan to your credit report. This can improve your credit score as it shows lenders that you can manage different types of credit, such as credit cards, personal loans, and installment loans. 3. Lower Credit Utilisation Ratio The credit utilization ratio refers to the amount of credit you use relative to the amount of credit available to you. A high credit utilisation ratio can negatively impact your credit score. Taking a gold loan can help lower your credit utilisation ratio as it provides you with additional credit that can be used to pay off other debts. This, in turn, can help you maintain a low credit utilisation ratio and improve your credit score. 4. Timely Repayments Making timely repayments on your gold loan is crucial to improving your credit score. Late payments can negatively impact your credit score, so it is essential to make sure that you make your payments on time. Consistently making timely payments on your gold loan can demonstrate your creditworthiness to lenders, leading to a higher credit score. In conclusion, taking a gold loan can positively impact your credit score in several ways. It can help you build a credit history, diversify your credit mix, lower your credit utilization ratio, and make timely repayments. However, it is essential to remember that taking a gold loan is still a financial obligation that requires responsible borrowing and repayment behaviour.