Happy to help you

Customer care 99610 33333

Toll free 1800 4257 774

Today's Gold Rate: ₹14,376.00/gram

Gold Loan Per Gram Rate* : ₹10,782.00

*terms & conditions apply

How to Choose the Right Gold Loan Company in Kerala

Aug 28, 2024

How to Choose the Right Gold Loan Company in Kerala

In recent years, the demand for gold loans in Kerala has surged, driven by economic uncertainties and cultural factors. Secure gold loans have become a popular choice for individuals seeking quick and accessible financial solutions. However, with numerous options available, selecting the right one among the best gold loan companies is crucial for ensuring both financial security and peace of mind.

Gold loans offer a valuable financial product, particularly in Kerala, where gold holds significant cultural and economic importance. They provide a quick way to access funds by leveraging gold as collateral, making them an attractive option during urgent financial needs. This blog will explore the essential factors to consider and the common mistakes to avoid when choosing the right gold loan company in Kerala, ensuring you make an informed and beneficial decision.

Understanding Gold Loans

What is a Gold Loan?

A gold loan is a secured loan where you pledge your gold ornaments or jewelry as collateral to obtain a loan from a financial institution. The loan amount is determined based on the value of the gold pledged. The process is straightforward: you submit your gold, and the lender assesses its value to offer you a loan.

Kerala gold loans demand more as the benefits of opting for a gold loan include lower interest rates compared to unsecured loans and quick processing times. Unlike other financial products, gold loans do not require a credit score, making them accessible to a wider range of individuals.

Why Gold Loans are Popular in Kerala

In Kerala, gold loans are not just a financial solution but also a cultural norm. Gold is traditionally considered a secure investment and a symbol of wealth. Economic factors such as fluctuating market conditions and agricultural needs also drive the popularity of gold loans.

Types of Gold Loans

There are various types of gold loans available in the market: Short-term Gold Loans: Ideal for immediate needs with quick repayment options.

Long-term Gold Loans: Suitable for extended financial requirements, offering longer repayment periods.

Agricultural Gold Loans: Tailored for farmers and agricultural needs, often with special terms.

Key Factors to Consider When Choosing a Gold Loan Company

Interest Rates: Gold loan Interest rates in kerala play a crucial role in determining the overall cost of your loan. It is essential to compare interest rates offered by different companies in Kerala to secure the most competitive rate. Lower rates can significantly reduce your repayment burden. Research and compare rates through online platforms or directly with lenders.

Loan Tenure: Gold loan tenure affects both the loan amount and the total interest paid. Understanding the different tenure options and choosing one that aligns with your financial situation is vital. Shorter tenures mean higher EMI amounts but lower overall interest, while longer tenures offer lower EMIs but may result in higher total interest.

Loan-to-Value Ratio (LTV): The Loan-to-Value ratio of gold loans (LTV) determines the percentage of the gold's value that can be borrowed. A higher LTV ratio allows you to borrow a larger amount against your gold. It’s crucial to understand how LTV affects the loan amount you can access and choose a company that offers favorable LTV terms.

Repayment Flexibility: Repayment flexibility is important for managing your loan comfortably. Look for companies offering various gold loan repayment options, such as EMI, bullet payments, or flexible schedules. Choosing a company that accommodates your financial situation can ease the repayment process.

Security and Transparency: Security and transparency are critical when selecting a gold loan company. Ensure that the company follows stringent security measures to protect your gold and has transparent policies regarding loan terms. Check for certifications or affiliations with regulatory bodies to confirm their credibility and gold loan security.

Reputation and Credibility of Gold Loan Companies

Checking Company Credentials

Verify the gold loan company credentials by checking their registration with relevant authorities like the RBI. Best gold loan companies with proper regulatory approvals are more likely to provide reliable services.

Customer Reviews and Testimonials

Research gold loan company reviews and testimonials to gauge the company's reputation. Look for feedback on service quality, loan processing times, and customer satisfaction. Positive reviews and testimonials can indicate a trustworthy lender.

Branch Network and Accessibility

A wide branch network is beneficial for convenience and accessibility. Choose a company with branches located near you in Kerala to ensure easy access to services and support.

Customer Support and Service

Good gold loan customer service is essential for a smooth loan experience. Look for companies that offer responsive and helpful customer support. Examples of excellent customer service practices include clear communication, prompt assistance, and efficient problem resolution.

Additional Services and Benefits

Insurance Coverage: Opting for a company that provides gold loan insurance coverage for your gold adds an extra layer of security to your loan. Insurance ensures that your gold is protected against loss or damage.

Prepayment and Foreclosure Options: Gold loan prepayment and foreclosure options allow you to repay your loan early without heavy penalties. This flexibility can help you save on interest and manage your finances better.

Additional Perks: Some companies offer additional benefits like free storage, zero processing fees, and promotional offers. Explore these perks to maximize the advantages of your loan.

Promotions and Offers: Take advantage of seasonal promotions or special gold loan offers that may be available. These offers can provide financial benefits or lower costs.

Common Mistakes to Avoid When Choosing a Gold Loan Company

Ignoring the Fine Print: Always read and understand the terms and conditions before signing any agreement. Ignoring the gold loan fine print can lead to unforeseen charges or unfavorable terms.

Overlooking Hidden Charges: Be aware of common gold loan hidden charges such as processing fees and documentation charges. Ensure you have a clear understanding of all costs associated with the loan.

Choosing Based Solely on Interest Rates: While interest rates are important, they shouldn’t be the only factor in your decision. Consider other aspects such as loan tenure, LTV ratio, and customer service to make a well-rounded choice.

Not Verifying Company Reputation: Avoid choosing lesser-known or unverified companies. Verifying the company’s reputation can prevent choosing gold loan company mistakes and ensure a smooth loan experience.

Steps to Take After Selecting a Gold Loan Company

Documentation Preparation: Prepare the necessary gold loan documentation for your gold loan application. Common documents include ID proof, address proof, and gold valuation reports. Organize these documents to facilitate a hassle-free application process.

Gold Valuation Process: Understand the gold loan valuation process and ensure that your gold is valued fairly. The valuation will determine the loan amount you can access, so it’s essential to ensure accuracy.

Finalizing the Loan Agreement: Before signing the loan agreement, double-check all terms and conditions. Ensure that you are comfortable with the loan’s terms and have clarity on repayment schedules and other details before finalizing the gold loan.

Conclusion

Choosing the right gold loan company in Kerala involves careful consideration of various factors such as interest rates, loan tenure, LTV ratio, repayment flexibility, and company reputation. Thorough research and informed decision-making are key to securing a beneficial gold loan from one Kerala gold loan company.

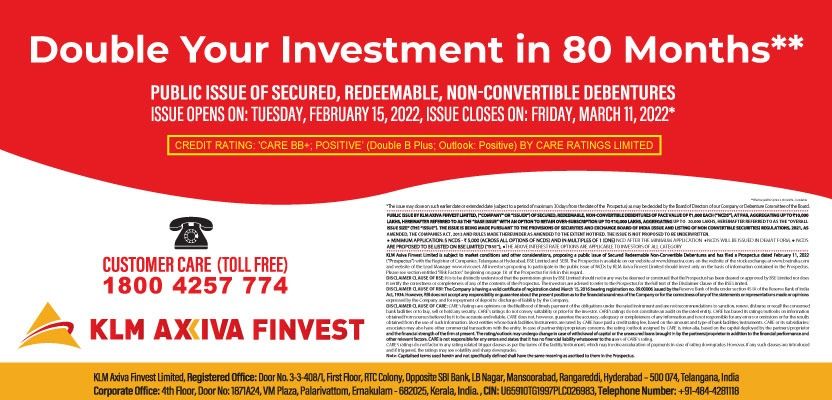

Why choose KLM Axiva Finvest

For those seeking a reliable gold loan provider, KLM Axiva gold loans stands out as a trusted choice in Kerala. With 25 years of legacy and known for its competitive interest rates, flexible repayment options, and strong security measures, KLM Axiva offers the best gold loan in Kerala . The company has received numerous accolades for its excellent services and boasts an extensive branch network across Kerala.

With exceptional KLM Axiva customer service and a commitment to transparency, KLM Axiva ensures a seamless gold loan experience. Visit your nearest KLM Axiva branch or explore their website for more information on their gold loan products and services.

Choosing the right gold loan company can make a significant difference in managing your finances. Make an informed decision with the help of this guide and experience the benefits of a secure and reliable gold loan.