Happy to help you

Customer care 99610 33333

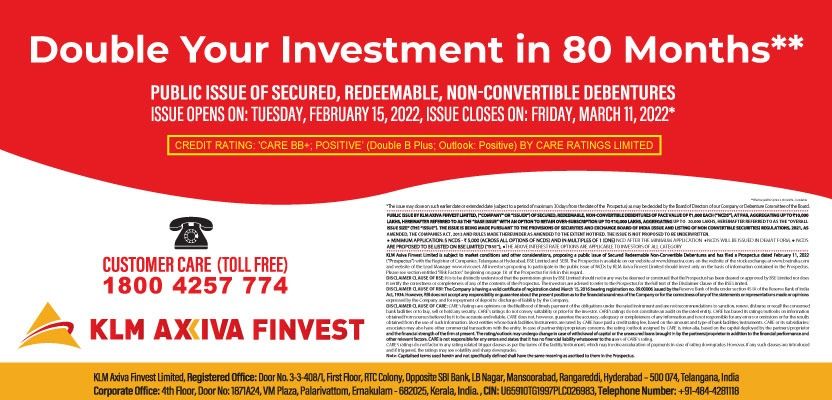

Toll free 1800 4257 774

Today's Gold Rate: ₹14,357.00/gram

Gold Loan Per Gram Rate* : ₹10,768.00

*terms & conditions apply

The Role of Small Business Loans in Empowering Entrepreneurs

Jan 2, 2024

Small businesses play a crucial role in driving economic growth and innovation. They encounter numerous challenges, such as limited capital, cash flow fluctuations, and difficulties in accessing credit. These obstacles can impede growth and innovation. Small business loans address these needs by providing the financial resources required for day-to-day operations, expansion, and overcoming unexpected challenges.

Challenges faced by small businesses

- Limited Capital: Many small businesses struggle with inadequate capital to invest in growth opportunities.

- Cash Flow Issues: Fluctuating revenue and delayed payments can disrupt cash flow, affecting daily operations.

- Limited Access to Credit: Traditional lending institutions often have strict criteria, making it challenging for small businesses to secure loans.

How small business loans can address these challenges

Entrepreneurs suffering financial difficulties can benefit from small business loans. They provide:

- Working Capital: Loans can cover operational costs, ensuring smooth day-to-day business activities.

- Expansion Opportunities: Entrepreneurs can use loans to expand their businesses, enter new markets, or launch innovative products or services.

- Equipment Purchase: Loans facilitate the acquisition of necessary equipment, enhancing productivity and efficiency.

Types of Small Business Loans

Small businesses often require financial assistance to navigate various stages of their growth and address specific needs. Here's a detailed overview of some common types of small business loans:

-

Term Loans

Term loans are traditional loans with a fixed repayment period and interest rate. They are suitable for businesses that require a lump sum of capital for specific purposes.

Tailored Features

- Fixed repayment schedule

- Suitable for long-term investments or projects

- May have a fixed or variable interest rate

-

SBA Loans (Small Business Administration Loans)

SBA loans are backed by the U.S. Small Business Administration, providing government support to lenders. They offer favourable terms and lower interest rates, making them an attractive option for small businesses.

Tailored Features

- Longer repayment terms

- Lower down payments

- Government-backed guarantee

-

Equipment Financing

Equipment financing is specifically designed for businesses that need to purchase or upgrade machinery, vehicles, or other equipment.

Tailored Features

- The equipment serves as collateral

- Flexible repayment terms

- Quick approval process

- Business Lines of Credit

A business line of credit provides a flexible, revolving credit line that businesses can draw from as needed. Interest is only charged on the amount used.

Tailored Features

- Revolving credit limit

- Interest-only payments on the used amount

- Quick access to funds

-

Microloans

Microloans are small loans, typically offered by non-profit organizations or community lenders, to support startups and small businesses.

Tailored Features

- Smaller loan amounts

- Simplified application process

- Often includes mentorship and support

These types of small business loans cater to diverse needs, allowing entrepreneurs to choose the option that best aligns with their specific requirements and financial goals.

Benefits for Small Businesses

Expansion Opportunities

Small business loans provide the crucial financial support needed for expansion initiatives. For instance, a local retail business in Kerala utilised a term loan to open a new branch, tapping into a growing market and increasing its customer base. This expansion not only elevated the business's reach but also contributed to job creation within the community.

Cash Flow Management

Managing cash flow is a perpetual concern for small businesses. Business lines of credit offer a solution by providing a flexible credit line. An example is a software startup in Kerala that used a line of credit to bridge gaps in cash flow during the development phases. This ensured timely payments to vendors and allowed the company to focus on innovation rather than liquidity challenges.

Equipment Purchase

Equipment financing proves instrumental for businesses in need of technological upgrades or essential machinery. A manufacturing unit in Mumbai utilised equipment financing to acquire advanced production machinery. This not only increased operational efficiency but also positioned the business to fulfil larger orders, resulting in increased revenue and market competitiveness.

Women Entrepreneur's Success with Microloan

A women-owned small business offering handmade crafts faced initial capital constraints. Leveraging a microloan, the entrepreneur expanded her product range, hired additional artisans, and gained access to larger markets. The microloan not only transformed her small venture into a sustainable business but also contributed to the economic empowerment of local artisans.

Eligibility Criteria for Small Business Loans

Eligibility for small business loans typically involves considerations such as a stable credit history, a well-defined business plan, and financial stability. Lenders may also assess the business owner's experience and the purpose of the loan. Meeting these requirements increases the chances of approval.

Application Process: A Step-by-Step Guide

- Assess Your Needs: Clearly define the purpose of the loan, whether for expansion, working capital, or equipment purchase.

- Choose the Right Loan Type: Based on your needs, select the most suitable loan type, considering factors like interest rates, repayment terms, and eligibility criteria.

- Gather Necessary Documentation: Prepare essential documents, including financial statements, business plans, and personal credit histories.

- Research Lenders: Explore various lenders, including traditional banks, online lenders, or government-backed institutions. To find the best fit, compare interest rates and terms.

- Complete the Application: Fill out the loan application, providing accurate and detailed information about your business, financial status, and the purpose of the loan.

- Submit Supporting Documents: Attach all required documents to support your application. This may include tax returns, bank statements, and legal business documents.

- Wait for Approval: The lender will review your application and may request additional information. Be patient during the evaluation process.

- Loan Approval and Terms: Once approved, carefully review the terms and conditions of the loan, including interest rates, repayment schedules, and any associated fees.

- Accept the Loan Agreement: If satisfied with the terms, accept the loan agreement and work with the lender to finalise any remaining details.

From overcoming financial hurdles to seizing growth opportunities, these small business loans cater to the unique needs of small businesses, offering a lifeline for expansion, efficient cash flow management, and vital equipment purchases.

Your journey as an entrepreneur is unique, and small business loans are there to empower you, ensuring that financial constraints don't limit your aspirations. Seize the possibilities, embark on a path of resilience, and let your business flourish with the support of small business loans.