Happy to help you

Customer care 99610 33333

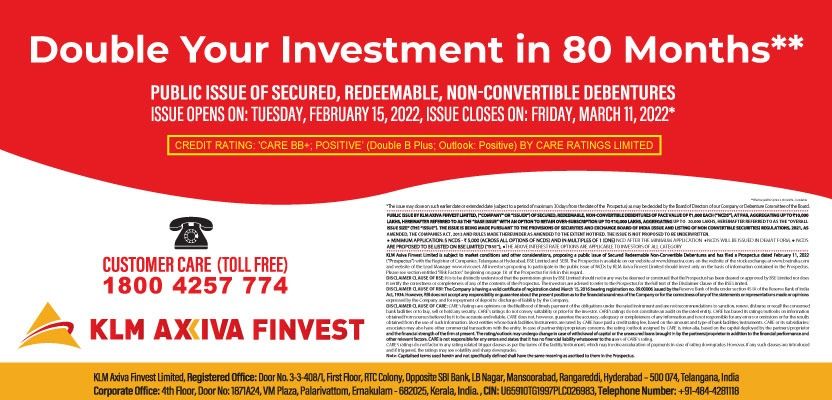

Toll free 1800 4257 774

Today's Gold Rate: ₹14,376.00/gram

Gold Loan Per Gram Rate* : ₹10,782.00

*terms & conditions apply

The Benefits of Taking a Gold Loan During Financial Emergencies

Oct 30, 2024

Introduction

In today's fast-paced world, financial emergencies can arise unexpectedly, leaving individuals in dire need of quick and accessible funds. One viable solution to consider during such times is a gold loan. A gold loan is a secured loan where individuals can pledge their gold jewelry or coins to borrow money from financial institutions. The advantages of gold loans are numerous, particularly their quick approval processes and easy access to funds, making them an attractive option for those facing urgent financial needs.

1. Immediate Access to Funds

One of the most significant benefits of taking a gold loan is the immediate access to funds. Unlike traditional loans, where one might need to go through a lengthy approval process, gold loans provide instant liquidity without the need to sell valuable assets.

Quick Processing Time

Gold loans are typically processed much faster than other types of loans, allowing borrowers to obtain funds within hours or even minutes of applying. Lenders evaluate the value of the pledged gold and, based on that, approve the loan swiftly. This is especially crucial during emergencies, where every moment counts.

Minimal Documentation Required

The documentation required for a gold loan is minimal, which adds to its appeal for individuals facing urgent financial needs. Most lenders only require basic identity verification and ownership proof of the gold being pledged. This streamlined process ensures that borrowers can access the funds they need without unnecessary delays, making gold loans an ideal choice for quick financial solutions.

2. Flexible Loan Amount Based on Gold Value

Another advantage of gold loans is that the loan amount is calculated based on the current market value of the gold being pledged.

Flexibility in Borrowing Amounts

The calculation of gold loan amounts is typically based on the gold loan gram rate at the time of borrowing. This flexibility allows borrowers to obtain smaller or larger amounts according to their needs. For example, if someone faces a medical emergency that requires immediate funds, they can secure a gold loan for a specific amount based on the value of their gold assets. Similarly, students needing funds for educational expenses or entrepreneurs seeking capital for business growth can benefit from this adaptable borrowing structure.

Coverage for Various Expenses

Whether it's unexpected medical bills, urgent educational fees, or sudden business expenses, gold loans can provide the necessary financial relief. This makes them a versatile option for anyone in need of immediate funds.

3. Lower Interest Rates Compared to Unsecured Loans

One of the most appealing aspects of gold loans is their competitive interest rates.

Benefits of Lower Interest Rates

Secured loans like gold loans generally come with lower gold loan interest rates compared to unsecured loans, such as personal loans or credit cards. This is primarily because the risk to lenders is reduced when borrowers offer collateral in the form of gold.

Comparison with Other Loan Types

For instance, personal loans and credit card interest rates can often be quite high, significantly increasing the total repayment amount over time. In contrast, the gold loan rate interest tends to be more manageable, providing a more affordable borrowing option. Many lenders offer the lowest gold loan interest rate in the market, making it a cost-effective choice.

Easing the Repayment Burden

Lower interest rates can alleviate the financial burden of repayment, allowing borrowers to pay off their loans without straining their finances excessively. This makes gold loans not only a quick source of funds but also a cost-effective solution.

4. No Impact on Credit Score

For many potential borrowers, concerns about their credit scores can deter them from applying for loans. However, gold loans present a unique advantage in this regard.

Accessibility for Those with Poor Credit History

Gold loans do not require a credit score check, making them accessible even for individuals with poor credit histories. This opens the door for a wider range of borrowers who might struggle to secure traditional loans due to their credit background.

Positive Impact of Timely Repayment

Moreover, borrowers who take gold loans and repay them on time can positively influence their credit scores, even if they started with a low rating. This dual benefit provides a pathway for financial recovery while addressing immediate monetary needs.

5. Flexible Repayment Options

The flexibility in repayment options is another compelling reason to consider a gold loan.Various Repayment Methods

Lenders offer various repayment structures, including Equated Monthly Installments (EMIs), bullet payments, and partial payments. This flexibility enables borrowers to choose a repayment plan that best suits their financial circumstances.

Customizing Repayment Terms

For example, someone facing a temporary financial setback may prefer to opt for a bullet payment option, allowing them to pay back the entire amount at once after a few months. Others may find that EMIs fit better into their monthly budgeting, making gold loans adaptable to individual financial situations.

6. Security and Safety of Pledged Gold

When it comes to pledging valuable assets, security is paramount.

High-Security Measures by Lenders

Reputable lenders implement high-security measures to ensure the safety of pledged gold. Most institutions provide insurance coverage for the gold during the loan tenure, giving borrowers peace of mind that their assets are well protected.

Assured Safety and Secure Storage Facilities

Additionally, lenders often utilize secure storage facilities equipped with state-of-the-art security systems. This assurance allows borrowers to focus on their financial needs without worrying about the safety of their pledged items.

Conclusion

As financial emergencies can happen to anyone, it's wise to consider gold loans as a go-to option for quick and efficient funding. If you're in need of a gold loan, KLM Axiva offers best gold loans with competitive rates and excellent customer service to help you navigate your financial challenges. For a hassle-free experience, KLM Axiva's Gold Loan App makes it incredibly easy to apply in just a few taps. Offering competitive rates and excellent customer service, KLM is the ideal partner to help you through financial challenges. Download the app today to explore your gold loan options and stay updated on the latest rates.